Cohort leaders are student representatives elected by their peers to represent their program. The cohort leaders are responsible for building cohort cohesion and serving as a liaison between the students and program faculty/staff by organizing events and overseeing communications.

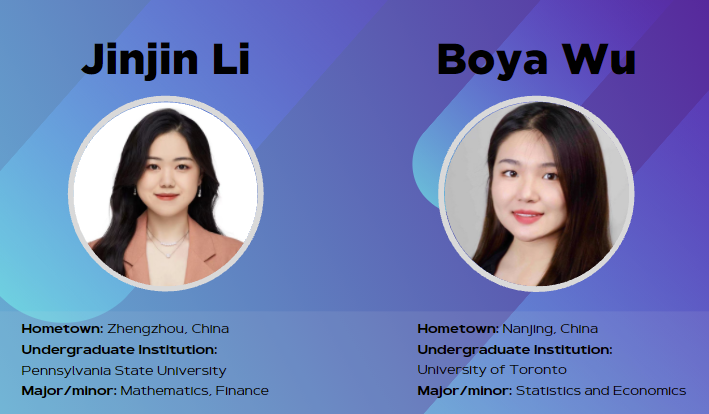

Meet this year’s cohort leaders for the MS in Quantitative Finance (MSQF) Class of 2022!

Q: What led you each to apply for the MSQF program?

Jinjin: Major choice was a big reason. My undergraduate background in math and finance has prepared me for basic knowledge of coding, modeling and foundation of finance. Therefore, the MSQF program seemed like a perfect fit for me in terms of furthering my understanding in these areas. Stern and NYU Shanghai were other big reasons. First of all, New York University is known for its prestigious business program and incredible alumni network. There is no doubt that I would love to work with the brightest minds and learn from the outstanding professors with backgrounds in academia and industry. Secondly, after six years of school life in the US, I gained a more comprehensive understanding in both western and eastern cultures. China, as the fastest growing economy in the world, presents more opportunities and possibilities in the financial industry. Shanghai will definitely be one of the financial centers globally in the next few decades, so I am excited to find a job in Shanghai after I finish this program.

Boya: The MSQF program attracted me at first glance for its cooperation with Stern School of Business. NYU Stern has been my dream school since I was 17, which was why I was very excited to find a program that allows me to stay in my home country, China, and also gain study experience at NYU Stern. NYU Shanghai’s perfect location provides me plenty of opportunities to coffee-chat, interview, and intern at the core of Asia’s financial center. It feels so natural to work at Lujiazui after graduation, since I’m already familiar with the district through daily classes. What differentiates MSQF from other graduate programs is also the hard-core course load. Within one-year, we gain in-depth knowledge of finance, which is essential for our career development.

Q: You just wrapped up your first few courses, Statistics, Foundations of Finance, and Corporate Finance, and are currently enrolled in Chinese Financial Markets and Volatility Modeling. What is your impression of the program so far?

Boya: The MSQF program has high expectations of students in terms of our understanding of finance. Unlike my expectation before taking Foundations of Finance, this course was way more detail-focused than financial courses during my undergrad. It required more than a shallow expression of all branches of finance. In terms of statistics, the MSQF program expects candidates to have a general understanding of statistical methods. Though data analysis is widely used in financial services, we might not need as in-depth knowledge as those data analysts. Still, the statistics course prepared us well for thinking statistically.

Jinjin: I really enjoyed the relatively small class size and interaction with all my professors. They all came in with passions for teaching and profound knowledge of their expertise. In addition to the engaging lectures, a lot of them brought in guest speakers as supplements to the class. It has been intriguing to learn more about different aspects of the industry from practitioners.

Q: What other program or school resources have you utilized so far?

Jinjin: As an ambassador of the Career Development Center (CDC), I have been quite active in the Recruitment Preparation Series and Industry Speaker Series. I am also leading a research group to present about the recruitment process in PEVC. I also used some of the databases in company research. Wind and Bloomberg accounts were helpful as well.

Boya: The CDC is a place I also go to a lot. In addition to getting advice for my resume, I also talk to my career advisor, Ji, about career paths that fit with my characteristics and interests. The guest lectures also broaden my view of positions in different industries, and I would recommend that every student actively participate in CDC activities.

Q: You both mentioned that you would like to work in Shanghai. What are your career goals coming out of this program?

Boya: I see myself being a management consultant after finishing this program to continue my passion in helping bio-pharmaceutical companies.

Jinjin: I would love to work in the asset management industry after graduation. I would probably start with an entry position in fund or consulting and work my way to pe/vc.

Q: What are you looking forward to doing while in Shanghai this summer and fall?

Jinjin: I am working as an intern at Allianz Global Investor in Pudong while taking classes. Though my schedule is tight, I still try to make time to explore the city as much as possible. Shanghai is a fascinating city that is so inclusive and vibrant. I hope to make it feel like home and get my dream offer this fall.

Boya: I currently have an internship in the business consulting department of one of the Big 4 accounting firms. I am also working on building a strong connection with my fellow classmates, professors, and other school faculty members. I think NYU Shanghai is a great starting point for someone who wants to settle down and build a network in Shanghai.