The first annual China Derivatives Markets Conference (CMDC), co-organized by the Volatility Institute at NYU Shanghai, brought together academics, financial professionals and policy-makers from China and abroad to discuss current research on futures, options and other derivative markets--specifically about when China might introduce new derivatives to the financial market.

“We’re still lacking in numbers of derivatives and are analyzing the role they play in the financial market and whether China should introduce new derivatives to the market,” said Xin Zhou, Executive Director of VINS.

Highlights of the first CDMC on May 19 and 20 were keynote speeches by Wang Jianye, CEO of the US$ 40 billion Silk Road Fund and Director of Volatility Institute at NYU Shanghai (VINS), as well as senior academics of the Stern Business School of New York University, including Professor Stephen Figlewski.

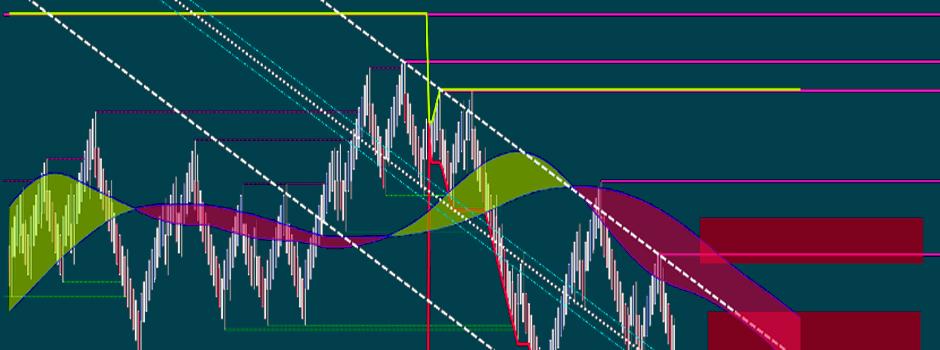

Global academics presented more than 30 papers on a range of subjects including the role of option trading in the financial market and future trading -- a selection of which will be published in a special issue of the Journal of Futures Markets, the China Financial Review International and the Review of Futures Markets.

The conference concluded with a panel session moderated by Xin Zhou on the Chinese financial derivatives markets. “This is a big thing. People are talking about timetables of when China will introduce options on individual stocks,” he said.

The event was organized jointly by VINS with the Journal of Futures Markets, the China Finance Review International, the Review of Futures Markets, International Business School Suzhou and the Institute of Quantitative Finance at Xi'an Jiaotong-Liverpool University.